If you’re a business owner, there’s a good chance you rely on seasonal workers in one way or another. Retail store operators often need help during the holidays due to the surge of shoppers, and fast-food franchisees can almost always use some additional assistance to keep up with demand. No matter which industry you’re in, however, there are some important seasonal employment laws that you must follow. We’re here to break down the basics and explain what you need to know to run a successful business without any legal hiccups.

Plus, if you’re looking to hire the ideal seasonal workers for your business, we can help with that too! Sprockets’ is an AI-powered platform that empowers you to hire more employees like your top performers. You’ll save time, build more productive teams, and be able to focus on daily tasks rather than the stressful hiring process.

Essential Information About Seasonal Employment Laws

How to Pay Seasonal Employees

Let’s start with some guidance for paying your seasonal employees properly. The Fair Labor Standards Act (FLSA) applies to part-time, temporary workers in the same way that it covers full-time, regular employees. That means you must pay non-exempt seasonal staff at least the federal minimum wage, which is $7.25 per hour. Keep in mind that if your state law has a different minimum wage, you must provide them with whichever rate of pay is higher.

Overtime for Seasonal Workers

The FLSA also treats seasonal employees the same as regular employees for the sake of overtime. So, you must pay temporary staff members at least 1.5x the regular rate for any hours they work above the standard 40 per week. It’s important to note, though, that you’re not required to automatically pay them more on weekends or holidays — only if they work overtime on these days. You are also exempt from the overtime requirement if your business falls into certain categories, such as seasonal amusement, organized camps, and non-profit educational institutions.

Note: Make sure you abide by the child labor provisions of the FLSA. Sixteen and 17-year-olds can work unlimited hours, but 14 and 15-year-olds can only work for limited periods of time outside of school hours.

Seasonal Worker Benefits

There’s also the question of whether or not you need to offer the same benefits to seasonal workers as you provide regular staff. This is a tricky one. Under the Affordable Care Act, employees may be entitled to minimum essential health coverage if they work 30 hours per week at your company, especially if you’re considered an applicable large employer (ALE).

Also, the Family and Medical Leave Act (FMLA) only applies to employees who work at least 1,250 hours in a year. While you might need to provide health insurance to seasonal employees under ACA, the typical seasonal employee will not fulfill the requirement for FMLA.

Seasonal Workers Taxes

Make sure you follow the labor laws for seasonal employees when conducting payroll with taxes and withholdings. Seasonal workers are essentially the same as regular employees in this regard. You must withhold for Social Security, Medicare, income tax, and the Federal Unemployment Tax Act (FUTA).

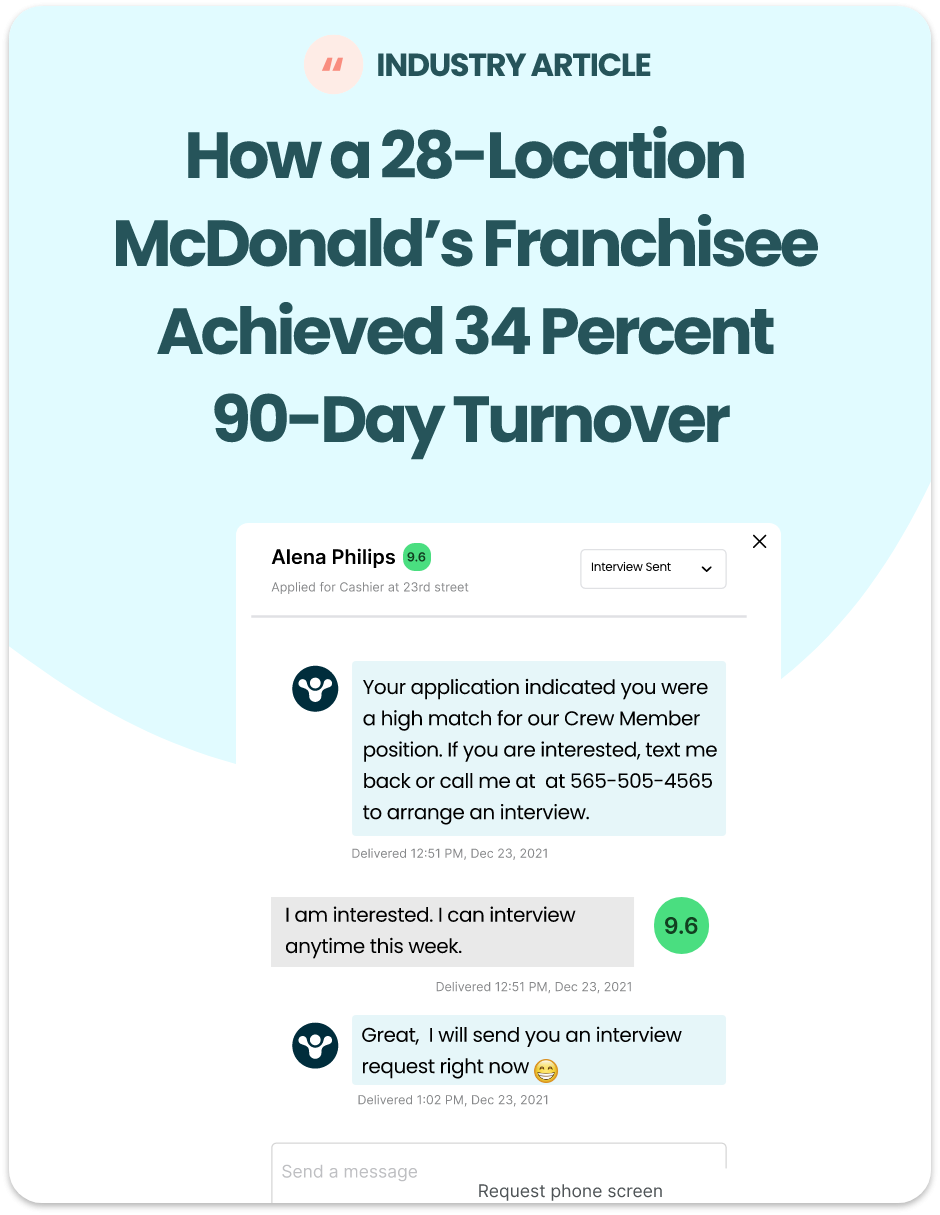

Simplify the Seasonal Hiring Process With Sprockets

You and your managers have enough to worry about with daily operations — let Sprockets handle the heavy lifting of the seasonal hiring process. Our AI-powered solution augments sourcing efforts with free job postings, screens candidates with background checks at 50% off what typical providers charge, and reveals which applicants will perform like your best workers. You get all these features and more in one convenient, easy-to-use platform that integrates with numerous top HR tools, like TalentReef and JazzHR.

You and your managers have enough to worry about with daily operations — let Sprockets handle the heavy lifting of the seasonal hiring process. Our AI-powered solution augments sourcing efforts with free job postings, screens candidates with background checks at 50% off what typical providers charge, and reveals which applicants will perform like your best workers. You get all these features and more in one convenient, easy-to-use platform that integrates with numerous top HR tools, like TalentReef and JazzHR.

Schedule a free demo today to start hiring the ideal applicants for your business!