Discover Which Applicants Are Eligible for Work Opportunity Tax Credits

The Sprockets platform makes it easy to view each applicant’s eligibility and the value of the tax credits received for hiring them. You could receive between $2,400 to $9,600 for each eligible person you hire, depending on their WOTC Target Group, such as SNAP Recipients, TANF Recipients, Supplemental Security Income Recipients, and Unemployed Veterans.

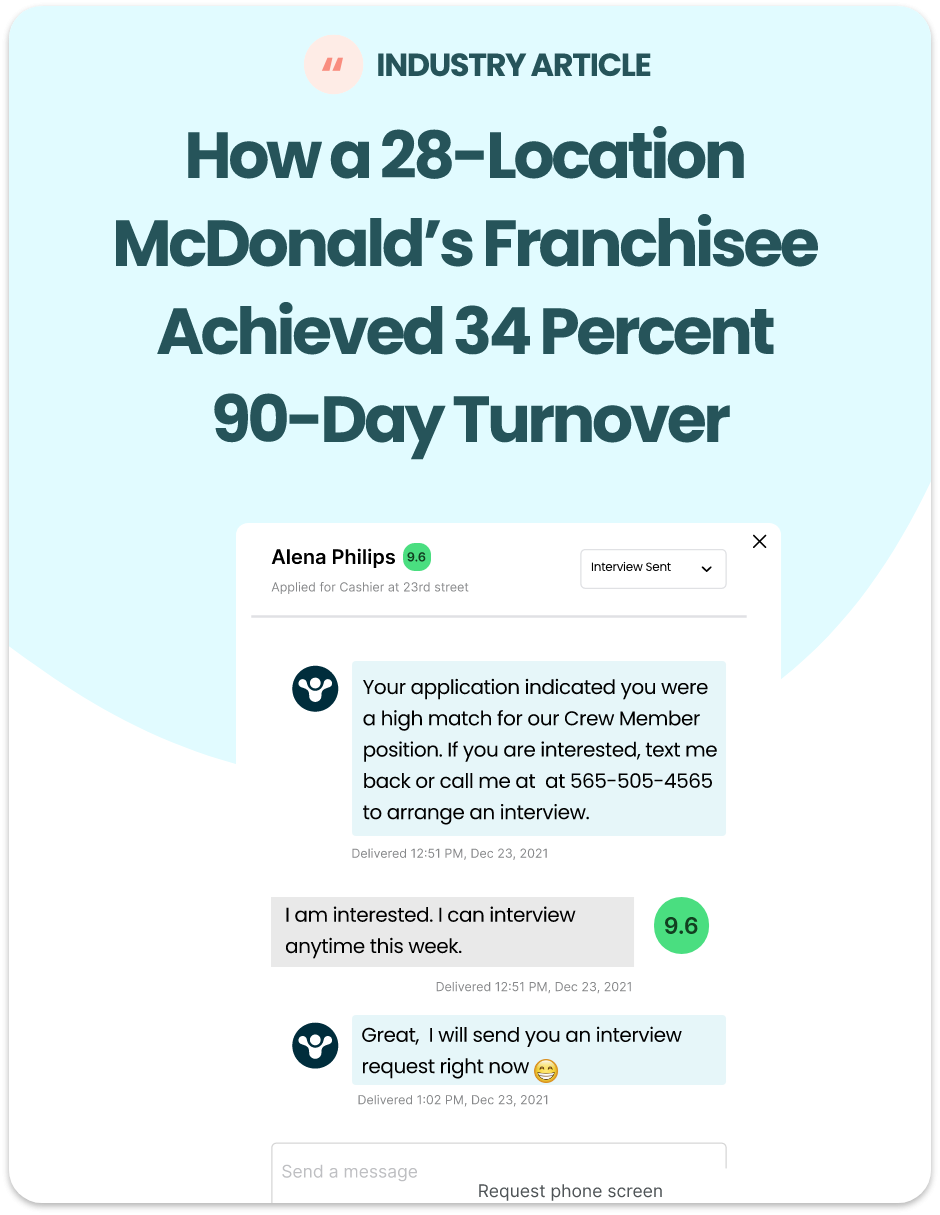

See Who Will Perform Like Your Best Employees

Our AI-powered software also displays which applicants will be excellent additions to your team. The process begins by creating a unique success profile based on the characteristics of your current top-performing employees and scores each incoming applicant against that benchmark. You’ll see “fit scores” next to WOTC eligibility in the dashboard, allowing you to hire the ideal applicants who will both succeed and provide tax credits.

Let Our Experts Take Care of the Details

As an added bonus, you have access to a dedicated WOTC tax expert to help you every step of the way. The expert will evaluate your new-hire process, send the WOTC questionnaire to applicants, set up the paperwork, give you completed IRS forms for easy filing, and answer any questions you may have. With all the time you save, you’ll be able to focus on the day-to-day operations of your business rather than dealing with the tedious tax process.

Start Maximizing Your WOTC Incentive Today

If you’re not already taking advantage of this program, now’s the time! Sprockets offers seamless integration with WOTC and our AI-powered Applicant Matching System. Schedule a demo today to see how our platform reveals WOTC eligibility, predicts success with pinpoint precision, and improves overall employee retention. We can’t wait to help you hire the ideal applicants and earn Work Opportunity Tax Credits!