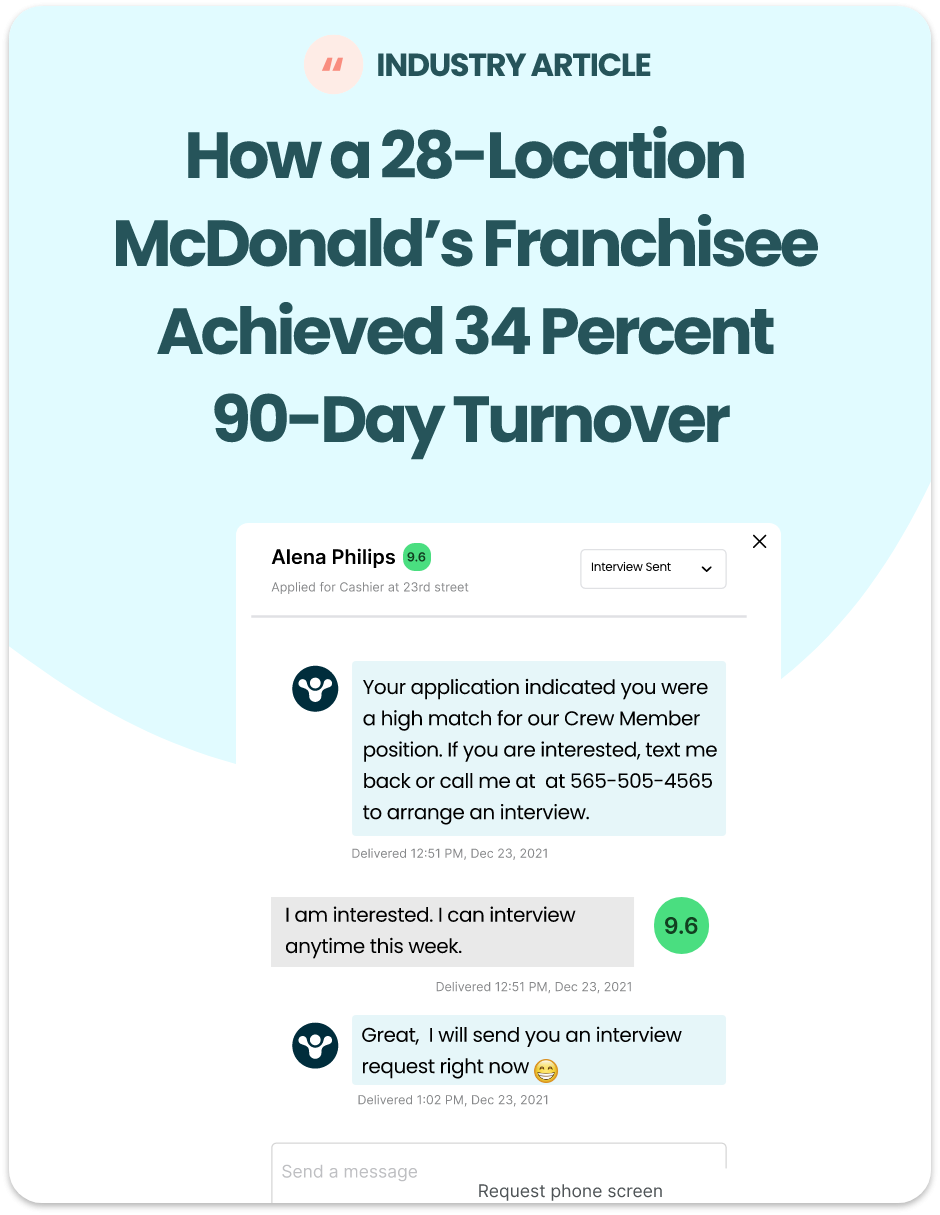

In this conversation, Natalie Commons, a principal at RetroTax, discusses the Work Opportunity Tax Credit (WOTC) and its significance for businesses hiring hourly workers. She explains how WOTC can help offset turnover costs and provide financial benefits to employers. The discussion covers eligibility requirements, compliance challenges, the political landscape affecting the program, and barriers to its utilization. Natalie also outlines the steps for business owners to implement WOTC and the pricing models for services related to it, emphasizing the importance of education and support in maximizing the benefits of this tax credit program.