Maximize Your Tax Credits With Our WOTC Assessment

Reveal your tax-credit potential with our WOTC assessment while hiring the ideal employees for your business. Our tax experts even take care of the paperwork for you.

Too many businesses today miss out on potential tax-credit savings from the WOTC program. Whether you don’t know enough about Work Opportunity Tax Credits or simply don’t have enough time to deal with all the paperwork, it’s basically like leaving money on the table. Plus, you’re missing out on a chance to offer meaningful opportunities to individuals who otherwise face barriers to employment. WOTC is a win-win.

Let Sprockets Simplify the WOTC Process

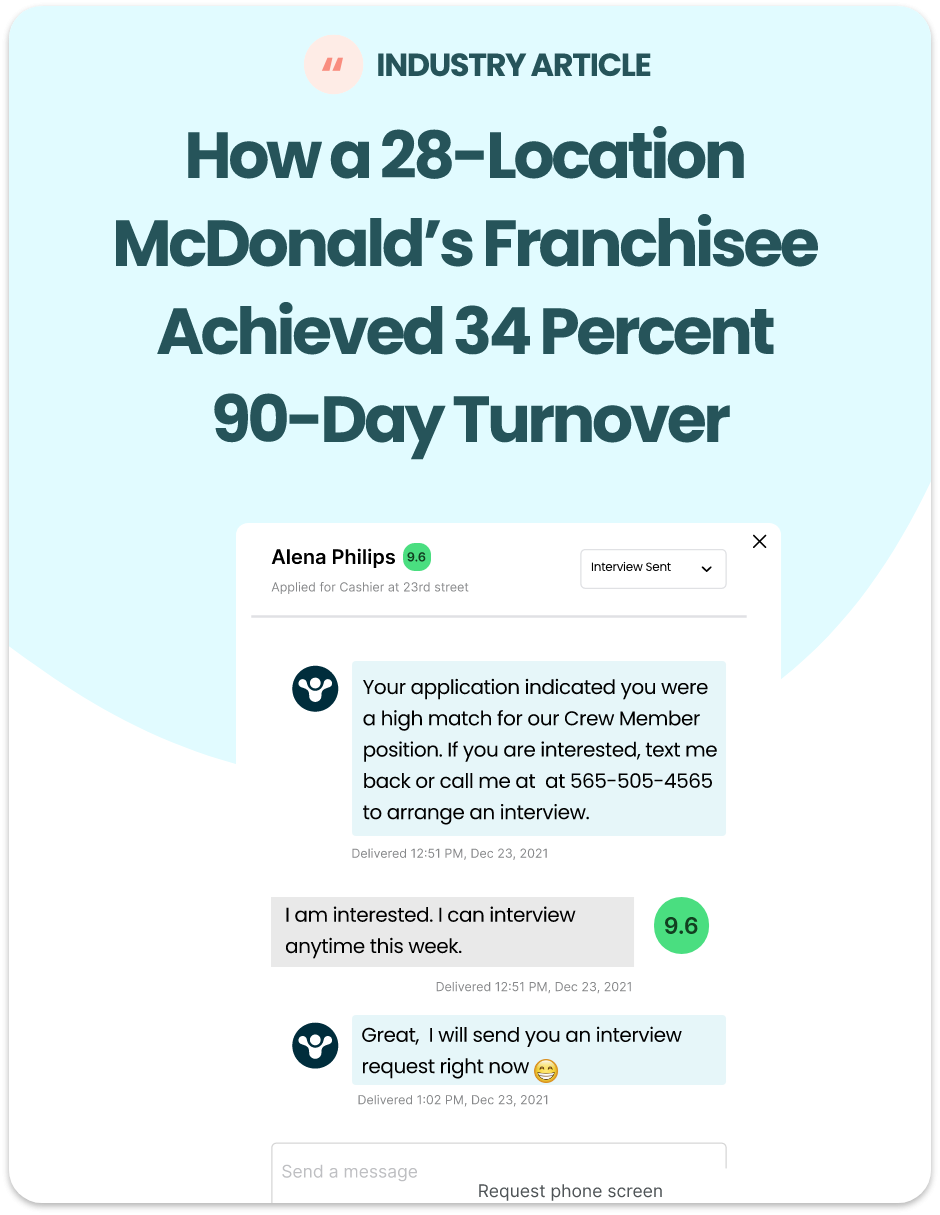

You can send the Work Opportunity Tax Credit questionnaire from Sprockets to view WOTC eligibility as well as fit scores in one place.

Consult With Tax Experts

Get access to WOTC experts to discuss your goals and set up your platform accordingly.

Don’t Worry About the Paperwork

Our partners handle the whole process, from filling out paperwork to filing with the IRS.

Redeem Valuable Tax Credits

You could potentially save thousands of dollars in WOTC tax credits each year.

Don't Just Hire Anybody. Create Simple Red-Yellow-Green Scores.

A simple red, yellow, or green indicator to sort through results and determine what actions to take next based on how well they match your top performers’ results.